In a sign the global chip shortage is easing, chip delivery times dropped in August, however some chips still remain scarce on the market.

Lead times, defined as the time between an order for a chip being placed and its delivery, were on average 26.8 weeks in August, according to data reported by Susquehanna Financial Group. That marked a one day decline from the previous month.

According to Susquehanna analyst Chris Rolland, much of the decline is attributable to declines in demand for some technology devices, such as cell phones and personal computers. However some other sectors of the industry remain overheated, as orders overwhelm production capacity.

In a note, he said, “We believe over-ordering trends and inventory builds have yet to work through the system.”

Dell Technologies Inc. Chief Financial Officer Tom Sweet noted that in the personal computer sector, the supply chain has mostly returned to normal operations. As availability has improved and demand has weakened, component costs are dropping, though he noted Dell is focused on clearing its inventory rather than taking advantage of lower prices right now.

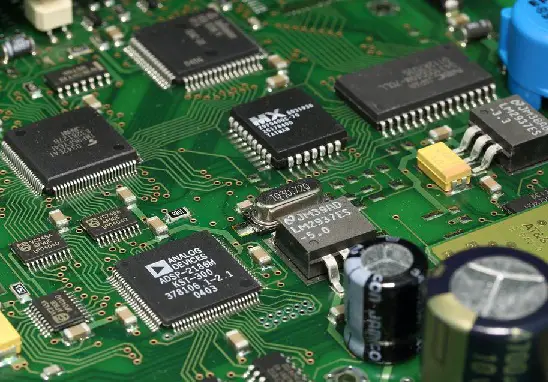

Due to the fact it takes months to manufacture many components, the chip industry often finds itself swinging between periods of oversupply and shortage. In addition, semiconductor manufacturers have found themselves producing a much broader array of chips for a much wider range of products as chips have become vital to the production of everything from household appliances, to cars, to factory equipment.

In the past, extended lead times were seen in the industry as a precursor to the overly short lead times indicative of a slump in the sector. In this case the fact the industry is recovering from the supply chain issues caused by the pandemic has analysts like Rolland noting a return to 10-14 week lead times would be “healthy.”

Rolland noted that the wait times for some power management, microcontroller, and optoelectronic devices are still extended. Manufacturers of those devices, including companies like Microchip Technology Inc. and Infineon Technologies AG, are working overtime trying to clear pending orders.

He noted that other chipmakers like Nvidia and Intel, however, are seeing demand decrease as demand for personal devices abates.

Chip investors are betting on a major downturn being in the works however, as the Philadelphia Stock Market Semiconductor Index has dropped 33% so far this year.