Alibaba is rising off word that its affiliate company, Ant Group, will be allowed to create a financial holding company, which could allow Ant Group to revive it’s chance at public listing.

Alibaba rose about 1% in early Friday trading to $102.41 after news broke. Shares gained as much as 11.1% over the day, before dropping back to $102.24 at close on Friday. The stock is up 8.1% over the month, but still down 12.6% for this year.

Unidentified sources told Reuters that the People’s Bank of China is now considering an application by Ant to form a financial holding company. Previously Ant would not have been able to get an application accepted due to the regulatory pressures being placed on the company by the government, which had prevented the IPO it attempted to set up in November 2020. That the application was accepted indicates Ant may have been able to improve its position relative to the government and get those regulatory pressures laxened.

Previously Alibaba cofounder Jack Ma had publicly criticized the Chinese government’s financial regulations, which had angered Beijing. As a result, President Xi Jinping personally stopped Ant’s IPO, according to the Wall Street Journal. Since then, Ant underwent a broad remodeling that it performed in conjunction with regulators.

Neither Alibaba nor the People’s Bank of China have commented on the story.

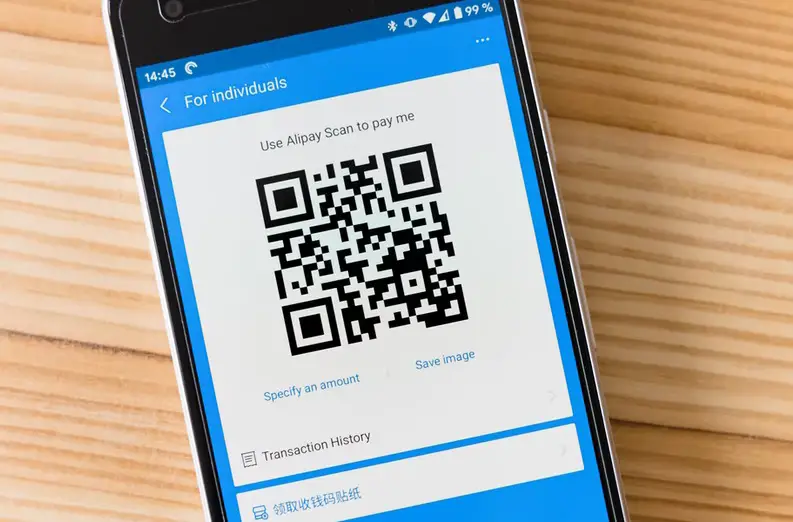

Headquartered in Hangzhou, China, Ant runs Alipay, a digital payment service which was rated the most trusted brand in China by the Morning Consult survey.

53% of Chinese consumers use Alipay daily, and according to the Ant website, it has 1.3 billion users. Launched in 2009, it is the top mobile payments option for consumers, alongside top competitor WeChat Pay, owned by Tencent holdings.

In the fall of 2020, when China began a regulatory crackdown on big technology corporations, Ant was one of the first companies targeted. But in recent weeks it seems Ant has somehow maneuvered into a position where regulators will allow it a freer hand to succeed. And that is making investors get optimistic about its prospects.