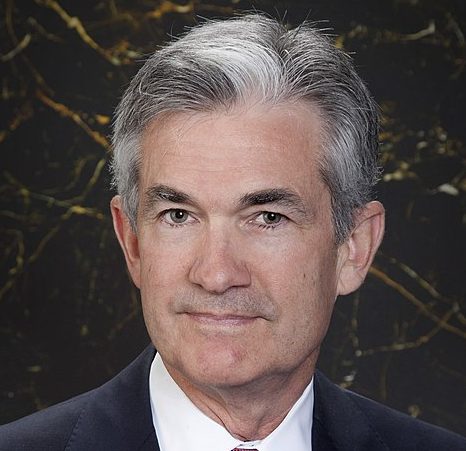

Federal Reserve Chair Jerome Powell, in his testimony to Congress Wednesday, admitted that Federal Reserve interest rate hikes could precipitate recession, as they try to tame runaway inflation.

Mr. Powell said, “It’s certainly a possibility. We are not trying to provoke and do not think we will need to provoke a recession, but we do think it’s absolutely essential” to bring inflation under control.

Inflation crept up on the economy, reaching the highest rate in 40 years suddenly, and has proven to be more widespread than it had appeared. As time goes on, hope that the Fed might be able to bring inflation under control without triggering a recession has been fading.

In a recent op-ed, former New York Fed Chair Bill Dudley said that at this point, a recession is inevitable.

Dudley wrote, “If you’re still holding out hope that the Federal Reserve will be able to engineer a soft landing in the US economy, abandon it. A recession is inevitable within the next 12 to 18 months.”

Bank of America analysts have forecasted a 40 percent chance the economy will sink into recession next year, and said it is more likely than not there will be a recession in the next 30 months. In a poll by the Financial Times, 70 percent of economists predicted a recession next year. The economy currently has zero growth according to the Atlanta Fed’s GDP Now growth tracker. And according to the New York Fed’s economic model, the economy will contract this year and the next.

For his part Powell said he felt executing a “soft landing” will be “very challenging.”

He went on, “The events of the last few months around the world have made it more difficult for us to achieve what we want.”

The Fed has been trying to dispel the perception they would act with caution, prioritizing jobs and economic growth over combatting inflation. Until recently, the Fed had been shown to be willing to tolerate some degree of inflation so as to not risk triggering a recession, even allowing inflation to exceed the target, if average inflation over a period remained on target. However recently the Fed changed tone, adopting a more uncompromising approach and calling inflation its top priority, as inflation continued to creep up.

According to the law, the Fed’s prime mandate is a dual-mandate – to pursue maximum employment and price stability. It is also charged with maintaining long term interest rates, though that is less frequently mentioned. Some would argue the Fed has failed in this last mandate by keeping rates so artificially low for such long periods.

Several Senators warned Powell against triggering a recession by raising rates too high however.

Senator Elizabeth Warren (D-MA.) said, “You know what’s worse than high inflation and low unemployment? It’s high inflation with a recession and millions of people out of work. I hope you consider that before you drive this economy off a cliff.”