Gareth Leather, Senior Economist in the Emerging Asia team at Capital Economics, wrote a note to clients highlighting the enormous ramifications to the world economy from the Chinese military drills currently ongoing off the coast of Taiwan following House Speaker Nancy Pelosi’s visit to the island nation. In it he pointed out, “Taiwan matters far more to the world economy than its 1% share of global GDP would indicate.”

So far the military drills, which include live-fire drills and missile launches, have restricted access to the island nation as ships and planes have been forced to navigate around the fire zones. According to Bloomberg data, over 40 vessels have already been forced to change course to avoid live fire zones surrounding the island’s main shipping port.

Leather wrote, “A further escalation in cross-strait tensions that cut Taiwan’s export off from the rest of the world would lead to renewed shortages in the automotive and electronics sectors and put further upward pressure on inflation.”

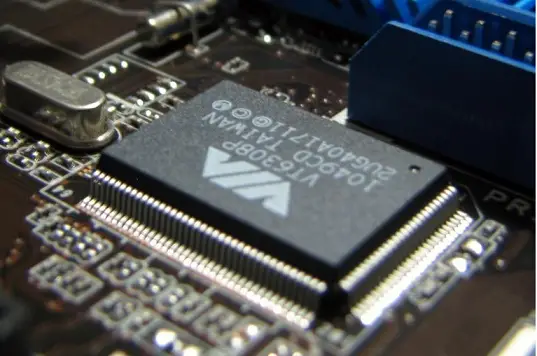

Leather also noted that Taiwan is the world’s largest manufacturer of the types of computer chips which are increasingly necessary to produce common appliances, with twice the market share of its next leading competitor. He also noted that 92% of the most advanced sub-10nm semiconductors are produced in Taiwan, making it even more critical to the world’s digital economy.

This means if Taiwanese semiconductor supplies were to become disrupted, manufacturers of everything from computers, to automobiles, to dishwashers and toasters would all suffer.

In 2021 the Biden administration produced a report which stated, “the United States is heavily dependent on a single company – TSMC – for producing its leading-edge chips… the lack of domestic production capability also puts at risk the ability to supply current and future national security and critical infrastructure needs.”

In response the US recently passed the Chips and Science Act, also called the CHIPS Act. It provided $52 billion in subsidies to America’s semiconductor industry, with about $39 billion allocated to support the construction of domestic US chip manufacturing facilities.

However until those new manufacturing facilities come online, the global chip supply infrastructure is vulnerable to the most severe level of supply disruption imaginable, and it will take two to three years to build these new semiconductor plants from scratch. Leather notes, if Taiwan semiconductor production is disrupted now, the implications will be, “extremely expensive,” and it will not be, “possible to re-establish TSMC’s most advanced facilities without its personnel and intellectual property.”

Another challenge would be that we would quickly develop an electronics shortage, which would massively amp up already record inflation levels across the entire globe. It would be worse than the pandemic supply chain crash.

Leather explained, “While electronic goods themselves make up a fairly small share of CPI baskets, widespread chip shortages would hit the output of a wider range of consumer goods and even digital services. Consequently, a major escalation over Taiwan would constitute yet another supply shock, keeping inflation high for even longer.”