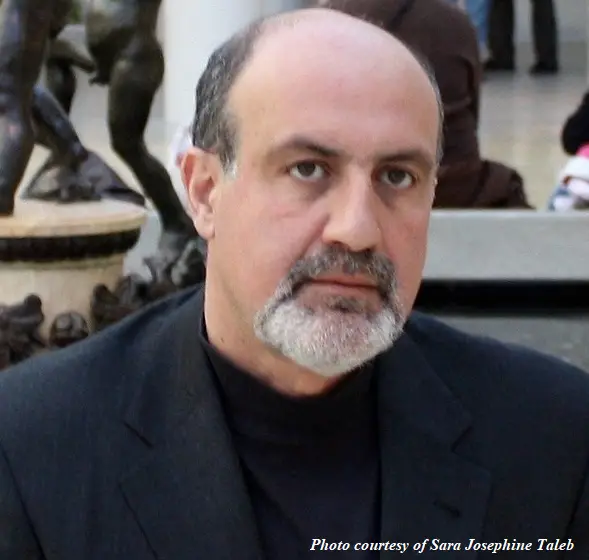

Nassim Taleb, the former banker and bestselling author of “The Black Swan,” is warning investors that rising interest rates are setting the market up for drastic changes across the world.

In a Tuesday interview with Bloomberg TV, Taleb noted that over the last decade and a half market players have grown accustomed to interest rates sitting at or near zero, a monetary policy implemented in an effort to try and boost the economy to lift it out of the 2008 financial crisis.

However the presence of that policy altered the basic rules by which the economy was operating, creating several asset bubbles which led to assets being traded at values far above their true values. Taleb estimates this has created over a half-trillion dollars in wealth, which he referred to as “illusionary wealth,” where market valuations were out of proportion to the cash flows of the companies.

Taleb said, “What do zero interest rates bring? Tumors. All these years, assets were inflating like crazy. It’s like a tumor, I think it’s the best explanation, because you’re happy with the growth, but it’s uncontrolled growth, and then ‘boom’.” He explained the “tumors” included everything from Bitcoin to skyrocketing real estate prices.

He went on to point out that if a company now earns under 4.75% of its total value, the present short-term interest rate within the US, technically it is losing money. As interest rates increase due to the Fed’s continuing focus on inflation, this will increase the chances that the asset bubbles which have been created by the low interest rates will begin to burst.

Taleb warned, “It doesn’t rain money anymore… Disneyland is over, the children go back to school. It’s not going to be as smooth as it was the last 15 years.”

Taleb remarked that current stock market levels cannot be justified unless the US interest rates return “miraculously” to near-zero levels. However he goes on to explain that the Fed now has “realized zero-rates don’t work” and generate only “cosmetic growth.”

He went on, “The stock market is way too overvalued, for interest rates that are not 1%… and this is unsustainable… The stock market has to adjust to normal levels,” although he said the markets will take some time to stabilize, and, “Things won’t be fine for a while. We have the weirdest valuations in history.”

Taleb has written three bestsellers on economics in addition to introducing the concept of the “Black Swan,” a difficult to predict and uncommon event which could not be foreseen, but which will have profound economic consequences.