On Saturday, the Indian Ministry of External Affairs (MEA) released a statement announcing that India and Malaysia have struck a deal to settle their trade obligations in Indian rupees.

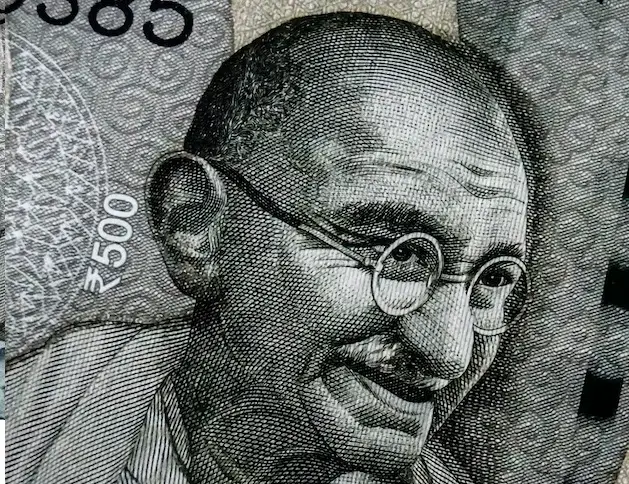

The deal is the latest blow to the US dollar’s status as a reserve currency, as well as the latest instance of India moving away from the greenback, as it looks to cement a global status for the rupee, and encourage its use in global trade settlement.

Already India had moved away from the dollar and toward the rupee in trade deals with sanctions-plagued Russia. It also has enacted a rupee-based payment mechanism with Iran for Iranian crude imports. Malaysia is the latest nations to switch from settling trade with India in US dollars to using rupees.

The MEA said in its statement, “This initiative by the Reserve Bank of India (RBI) is aimed at facilitating the growth of global trade and to support the interests of the global trading community in Indian Rupees (INR).”

It went on, “This mechanism will allow the Indian and Malaysian traders to invoice the trade in Indian rupee and therefore achieve better pricing for goods and services traded. This mechanism is expected to also benefit the traders on both sides as they can directly trade in Indian Rupee and therefore save on currency conversion spreads.”

The India International Bank of Malaysia has “operationalized” a Special Rupee Vostro Account, which will serve as the account which rupees will be transferred into and out of. A Vostro account is an account formed and held by a domestic bank on behalf of a foreign bank in the former’s currency.

In 2021 there was $17 billion in trade between India and Malaysia. 18 other countries, including Russia, Germany, Singapore, Sri Lanka, and Tanzania were authorized by the Reserve Bank of India to open Vostro accounts, which is expected to strengthen the standing of the rupee globally.

India also unveiled its new trade policy, which had been freshly updated for the next five years. The new trade policy looks to “encourage” the rupee’s widespread adoption, as it aims to diminish the nation’s use of the dollar in international trade. It also looks to increase Indian exports to $2 trillion by 2030.