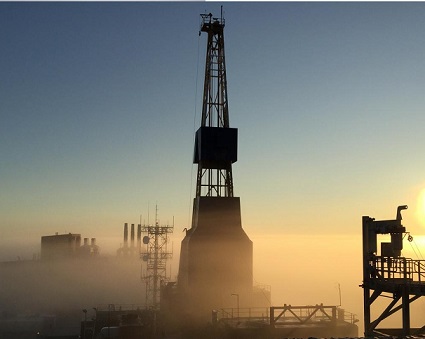

Oil producers have the fewest drilling rigs in active service right now, that they have had running since the beginning of the war in Ukraine, indicating they do not see prices rising anytime soon.

According to oil-field services firm Baker Hughes, as of this week, US oil drillers had 520 active drilling rigs up and running, a decrease from the previous week’s 525 rigs. It is the lowest total since March 4th in 2022, shortly after the invasion of Ukraine began, and the price of oil began to skyrocket.

Crude benchmarks have been dipping lower recently, as signs of economic rallying have stalled. In China especially, data shows reduced demand and a stalling recovery. In the Chinese property sector demand has fallen as property developers have begun to suffer from revenue issues and over-leveraging.

Chinese real estate giant Evergrande revealed it had suffered an additional $81 billion dollar combined loss for 2021 and 2022, giving it $330 billion in liabilities, leading investors to question the viability of the company’s planned reorganization to return to profitability at some point.

Meanwhile one of the biggest real estate developers in China, Country Gardens Holding Co, has revealed it had $194 billion in total liabilities at the end of 2022. The company has reportedly just missed coupon payments to bondholders on August 7th, starting the clock on a 30-day grace period before a default.

Real estate is responsible for roughly a fifth of the gross domestic product of China, sparking concerns the issues in the property sector could spiral out into other areas of the Chinese economy, impacting demand for oil in the world’s second largest consumer of the product.

The recent dip in crude prices ended a rally in prices which had run for seven weeks, driven primarily by production cuts implemented by OPEC+ producers to reduce supplies and stabilize prices, which had been in decline. Front-month West Texas Intermediate is presently trading at roughly $81 dollars per barrel.