On Wednesday, the Financial Times reported that according to sources with direct knowledge of the operations of Goldman Sachs, the US investment bank established a fund made up of Chinese government investment monies, which went on to purchase a number of American and British companies, including a firm which provided cybersecurity services to the British government.

According to the report, even as tensions have grown between Washington and Beijing over issues ranging from Washington’s efforts to hamper Chinese technological advancement, to China’s increasing belligerence over the status of Taiwan, Goldman has put together seven deals which have utilized funding from a $2.5 billion private equity “partnership fund” which the investment bank formed with the China Investment Corporation (CIC) in 2017.

With $1.35 trillion in assets as of the end of 2021, the CIC was formed in 2007 for the purpose of investing Chinese government funds. Its website notes that almost half of the CIC’s portfolio globally has been invested in private equity and other alternative assets.

Goldman Sachs purchased LRQA, the inspections and cybersecurity unit of the UK’s maritime classifications group Lloyd’s Register, for the fund with CIC. LRQA, which operates in sectors ranging from aerospace and defense, to energy and healthcare, specializes in inspection and certification services.

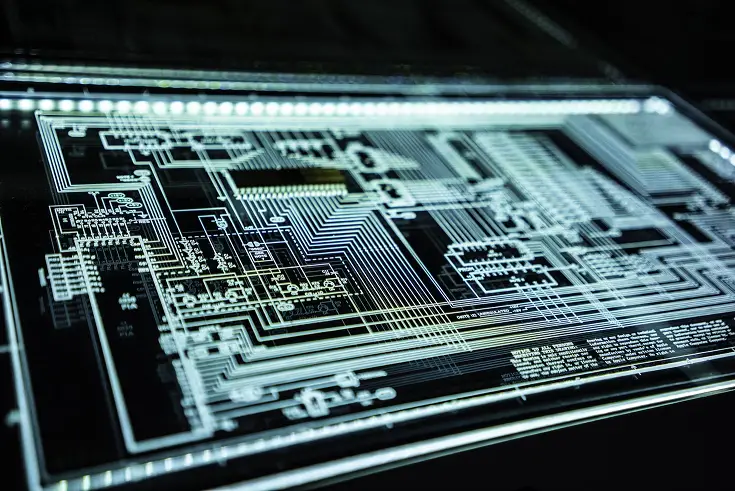

One part of the business is its cybersecurity group Nettitude, which has a unit that specializes in “ethical hacking.” It is an approved provider of services to the UK government, which notes on its website that it helps to “strengthen government and defense organizations across the world,” by probing and identifying weaknesses in their cybersecurity which an adversary might exploit.

The FT quoted LRQA’s spokesman as saying, “China represents 40% of the global certification market and we are currently under-represented there, which is something we are seeking to address in part with assistance from the [Goldman-CIC] fund.”

Goldman Sachs, in a statement to the FT, said that “the co-operation fund is a US fund run by a US manager, and is managed to be in compliance with all laws and regulations,” adding that it “continues to invest in US and global companies, helping them increase their sales into the China market.”