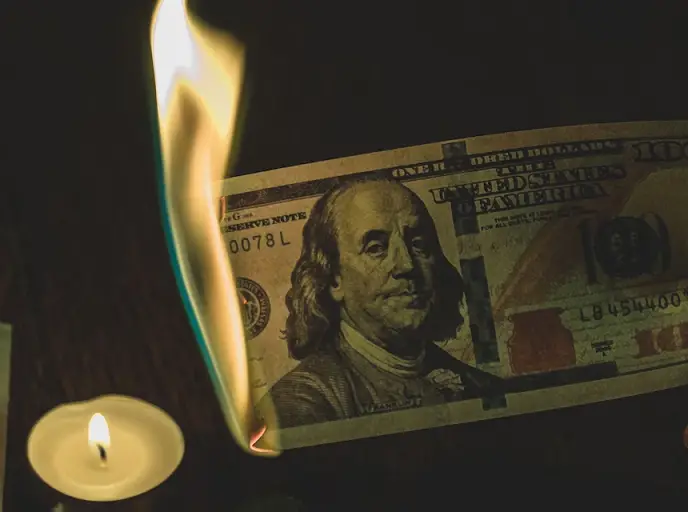

On Tuesday, Malaysian Prime Minister Anwar Ibrahim said that Malaysia is set to begin shifting away from the use of the US dollar in trade settlements, instead using local currencies, in an effort to reduce its reliance on the US dollar.

In a speech, Anwar said to his nation’s parliament, “To entirely stop the reliance on the US dollar will be difficult, but Malaysia will be more active and aggressive in the use of ringgit (in trade).”

In Southeast Asia, nations are increasingly moving away from the use of the US dollar in trade settlements. Anwar noted that Malaysia now shares agreements with Indonesia, Thailand, and China, the largest trading partner of his nation, to utilize local currencies more in trade and investment.

The nation is making the move as its currency, the ringgit, has endured a sharp decline against the US dollar. So far this year, the ringgit has lost roughly 7.6% of its value against the dollar, to trade close to historical lows.

Economists have noted that within Southeast Asia, nations are increasingly seeking to settle cross-border trade obligations using currencies other than the US dollar. Experts have begun to question whether the use of the dollar as a reserve currency has become obsolete, as nations increasingly move towards the use of local currencies, the Chinese yuan, or, in the case of the BRICS alliance of developing nations, a common currency derived from a basket of currencies which they are developing.